When you’re a home health care provider, your priority is always clear: delivering compassionate, reliable care to those who need it most. But behind the scenes, protecting yourself and your business with the right insurance is just as important. With so many options out there, it can be tough to know which policies truly have your back. That’s why we’ve put together this friendly guide to the top insurance picks for home health care providers—helping you find the coverage that fits your unique needs, so you can focus on what you do best. Let’s dive in!

Table of Contents

- Understanding the Unique Insurance Needs of Home Health Care Providers

- Choosing the Right Liability Coverage to Protect Your Business

- Exploring Workers Compensation and Disability Insurance Options

- Tips for Finding Affordable and Comprehensive Insurance Plans

- Closing Remarks

Understanding the Unique Insurance Needs of Home Health Care Providers

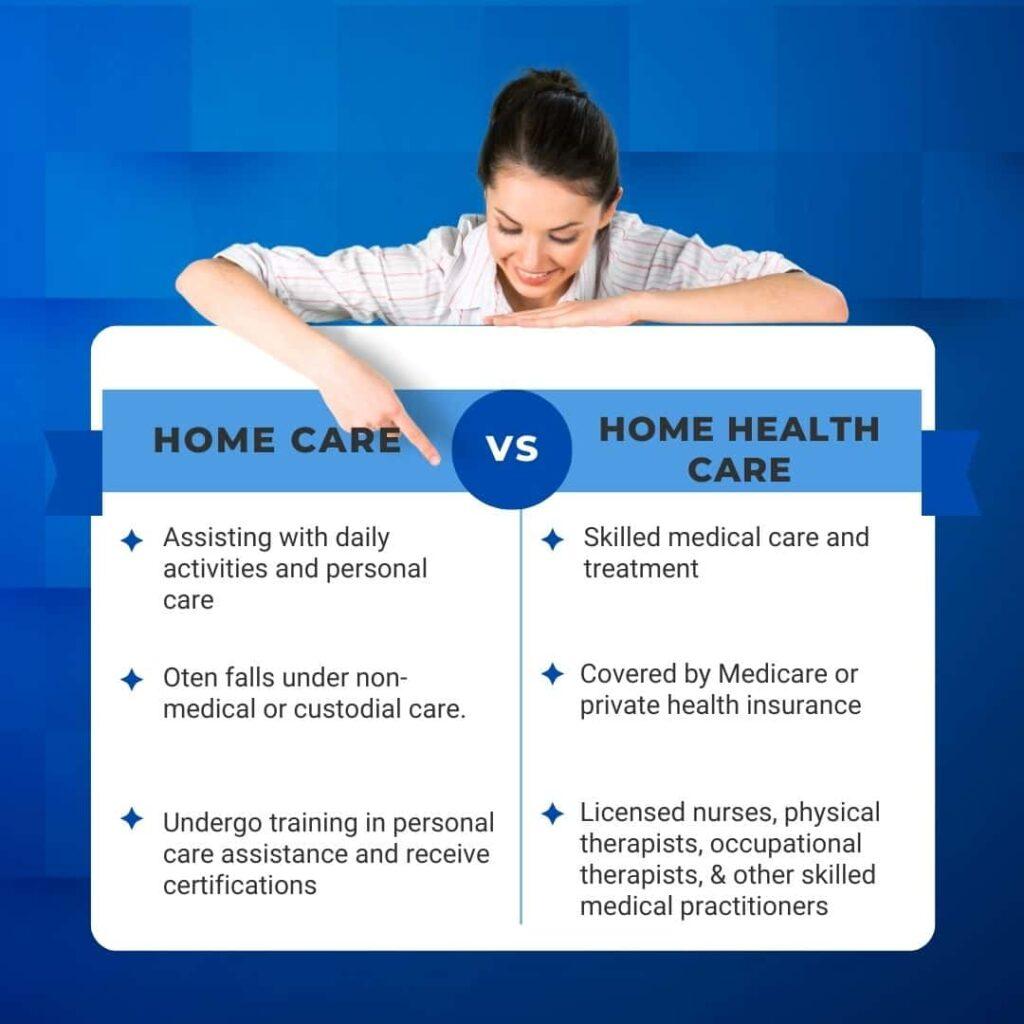

Home health care providers operate in a world where compassion meets complexity, creating a set of challenges that demand tailored insurance solutions. Unlike traditional businesses, these providers face risks related to patient care, staff safety, and regulatory compliance on a daily basis. From handling sensitive patient information to managing the delicate balance of medical equipment and personal care, the unique environment calls for coverage that goes beyond the basics. Providers must prioritize policies that protect against professional liability, ensure worker safety, and cover potential property damages — all while maintaining peace of mind that their services can continue uninterrupted.

When thinking about insurance, consider the crucial components that form a safety net for your practice. Key coverage types often include:

- Professional Liability Insurance – Shields against claims of medical malpractice or errors in patient care.

- General Liability Insurance – Protects against everyday risks like slip-and-fall accidents on your premises.

- Workers’ Compensation – Covers employee injuries sustained during onsite visits or while assisting patients.

- Cyber Liability Insurance – Essential for safeguarding confidential patient data in an increasingly digital world.

Recognizing these specific needs enables home health providers to not only mitigate risks but also build a foundation of trust and security for their clients and staff alike.

Choosing the Right Liability Coverage to Protect Your Business

When safeguarding your home health care business, selecting the right liability coverage is crucial for shielding your assets and reputation. General liability insurance typically covers bodily injury or property damage claims, which are common in this hands-on profession. However, for providers who administer medical care, professional liability insurance—often called malpractice insurance—is indispensable. It protects against claims of negligence or errors in care that could put your client’s health at risk. Understanding the scope of each policy and how it aligns with your services ensures that you’re not caught off guard by uncovered incidents.

Consider tailoring your coverage with add-ons that address specific risks unique to home health care providers. Examples include:

- Cyber liability to protect sensitive patient records from data breaches

- Employee practices liability for issues related to your staff’s conduct

- Business personal property coverage to safeguard medical equipment in client homes

Partnering with an insurer who understands the nuances of your field can make a world of difference, offering policies that are both comprehensive and affordable.

Exploring Workers Compensation and Disability Insurance Options

Home health care providers face unique challenges that require specialized insurance coverage tailored to the demands of their profession. Workers compensation insurance is essential for protecting both the employer and employees from the financial burdens associated with workplace injuries or illnesses. Unlike standard plans, policies for home health care workers often encompass additional coverage for ergonomic injuries, travel-related incidents, and patient-handling accidents, which are common in this field. Choosing a provider that understands these nuances can help ensure swift claims processing and fair compensation.

Disability insurance is another critical component to consider, especially since the physical and emotional demands of home health care can sometimes lead to temporary or permanent disabilities. This type of insurance helps maintain income stability for workers when they cannot perform their duties due to illness or injury. Look for plans that offer comprehensive benefits including:

- Short-term disability coverage for acute injuries or illnesses

- Long-term disability protection for chronic or lasting conditions

- Rehabilitation support to aid in recovery and returning to work

- Flexible premium options to accommodate fluctuating incomes common in home care roles

Tips for Finding Affordable and Comprehensive Insurance Plans

Finding the perfect insurance plan that balances cost-effectiveness and comprehensive coverage can feel like navigating a maze. Start by researching providers who specialize in home health care insurance, as they often tailor their plans to meet the unique needs of caregivers and clients alike. Comparing quotes online is a great first step, but don’t stop there—reach out directly to agents or brokers who can clarify policy details and uncover hidden benefits. Keep an eye out for plans that offer flexibility, such as customizable deductibles and coverage options, so you can fine-tune your protection without overspending.

Another smart move is to tap into your professional network or join support groups for home health care providers. These communities often share firsthand experiences and recommendations that can save you time and money. When evaluating policies, prioritize those that cover essential risks like liability, equipment damage, and worker’s compensation. Lastly, always read the fine print to ensure there are no unexpected exclusions or caps on claims. Doing this homework upfront can protect you from costly surprises down the road, giving you peace of mind while you focus on delivering excellent care.

Closing Remarks

Choosing the right insurance coverage is a crucial step for any home health care provider looking to protect their business, employees, and clients. With the options outlined here, you’re well on your way to finding a plan that fits your unique needs and gives you peace of mind. Remember, the best insurance isn’t just about ticking boxes—it’s about ensuring you can focus on what truly matters: delivering compassionate, quality care. Have you found an insurance provider that works best for you? Feel free to share your experiences or ask any questions in the comments below—we’d love to hear from you!