When storms strike, their fury is more than just thunder and lightning—it’s the shattering of homes, the disruption of lives, and the unraveling of dreams. Behind every headline about fierce winds and relentless rain lies a quieter, more heartbreaking story: the mountain of insurance claims that follow in the storm’s wake. For many, these claims aren’t just paperwork; they’re a lifeline amid devastation. Yet, navigating this process often brings its own storm of frustration, uncertainty, and sorrow. In this article, we delve into the emotional and financial toll that storms inflict through insurance claims, shedding light on the struggles families face as they strive to rebuild what was lost.

Table of Contents

- The Shattered Lives Behind Every Claim: Stories of Loss and Resilience

- Hidden Costs That Break More Than Just Wallets

- Navigating the Claims Process When Time Feels Like the Enemy

- How to Protect Your Home and Heart Before the Next Tempest Strikes

- In Retrospect

The Shattered Lives Behind Every Claim: Stories of Loss and Resilience

Behind every insurance claim lies a deeply personal narrative of hardship and hope. Families displaced from their homes, businesses plunged into uncertainty, and communities left to rebuild not just walls but shattered dreams. These stories are stitched together by moments of profound loss:

- Homes flooded beyond repair, memories washed away with the rising waters.

- Livelihoods destroyed overnight, leaving hardworking people with nothing but resilience.

- The quiet grief of irreplaceable heirlooms turned to debris after relentless storms.

Yet amid this devastation, there is an undeniable strength. Survivors find courage in community support, in the hands that help clear wreckage, and in the refusal to be defined by disaster. Their journeys illuminate a truth that transcends damage and dollar figures — the human spirit’s remarkable capacity to endure, rebuild, and rise again.

Hidden Costs That Break More Than Just Wallets

When disaster strikes, the financial shock delivered by insurance claims often pales in comparison to an avalanche of hidden expenses that sneak in unnoticed. Beyond deductibles and premium hikes, many find themselves grappling with uncovered damages—from mold remediation to temporary housing costs—that slowly chip away at their savings and peace of mind. These concealed fees don’t just drain wallets; they fracture stability, adding layers of stress on families already reeling from loss.

Survivors of storms frequently encounter a tangled web of pitfalls that insurance policies barely address:

- Hidden repair costs for structural weaknesses uncovered only after initial fixes

- Delayed claim processing leading to prolonged displacement and financial insecurity

- Expenses arising from inadequate coverage limits or fine print exclusions

It’s a cruel irony that what should be a safety net ends up entangling victims in a complex maze of red tape and unexpected bills, breaking more than just their wallets—it erodes hope and resilience when they need both the most.

Navigating the Claims Process When Time Feels Like the Enemy

In the immediate aftermath of a devastating storm, when your world feels shattered, the insurance claims process can become an overwhelming maze. Every ticking minute can heighten anxiety, as the damage around you demands urgent attention while waiting for approval feels impossible. To regain a sense of control, it’s crucial to take deliberate steps:

- Document every inch of the damage with photos and videos to create an irrefutable record.

- Keep detailed notes of all communication with

How to Protect Your Home and Heart Before the Next Tempest Strikes

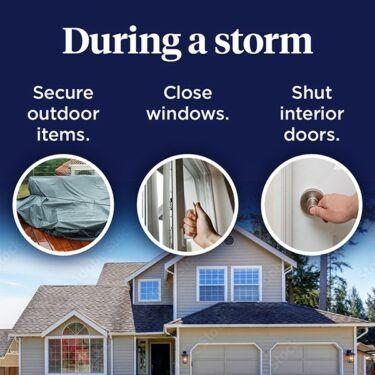

Storms don’t just ravage the landscape—they leave deep cracks in the safety and security we take for granted. Before the skies darken, it’s vital to fortify both your physical sanctuary and emotional resilience. Start with a comprehensive home inspection to spot vulnerabilities like loose shingles, weak window seals, or clogged gutters. Investing in storm shutters or impact-resistant windows can be a game-changer when fierce winds arrive, reducing damage and heartache. Don’t forget to create an emergency kit stocked with essentials like flashlights, bottled water, medications, and important documents—simple preparations that protect peace of mind when chaos hits.

Beyond bricks and mortar lies the equally critical task of preparing your heart for what’s to come. Facing a storm’s aftermath can be overwhelming, but leaning on community support and mental health resources can make an immeasurable difference. Keep these essentials in mind:

- Connect with neighbors: A strong network fosters quicker recovery and emotional comfort.

- Document all damage: Take photos before and after the storm to ease the insurance claims process.

- Stay informed: Reliable updates help you make calm decisions instead of reactive ones.

By safeguarding your home and nurturing your emotional wellbeing, you prepare yourself to withstand not just the storm’s fury—but its lasting impact on your life.

In Retrospect

As we reflect on the stories behind the numbers, it’s clear that the impact of storms extends far beyond damaged roofs and flooded basements. Each insurance claim represents a life disrupted, a family grappling with loss, and a community striving to rebuild from the debris of devastation. While policies and payouts matter, the true cost is felt in resilience tested and hope renewed. In the face of nature’s fury, we must remember the human hearts at the center of every claim—reminding us why compassion, preparedness, and support are more important than ever when storms strike.

Related Products