Picture this: you’re cruising through life with your regular insurance policies—auto, home, maybe even renters—feeling pretty secure. But what if a big accident or unexpected lawsuit comes out of nowhere and those policies just don’t cut it? That’s where umbrella insurance steps in, offering an extra layer of protection that could be a total lifesaver. In this post, we’re diving into why umbrella insurance might be your best extra protection, how it works, and why more people are adding it to their safety net. Trust us, once you get the scoop, you’ll wonder why you didn’t consider it sooner!

Table of Contents

- Understanding What Umbrella Insurance Covers Beyond Your Basic Policies

- How Umbrella Insurance Can Save You from Costly Lawsuits

- Who Should Consider Umbrella Insurance and When to Get It

- Tips for Choosing the Right Umbrella Insurance Policy for Your Needs

- To Conclude

Understanding What Umbrella Insurance Covers Beyond Your Basic Policies

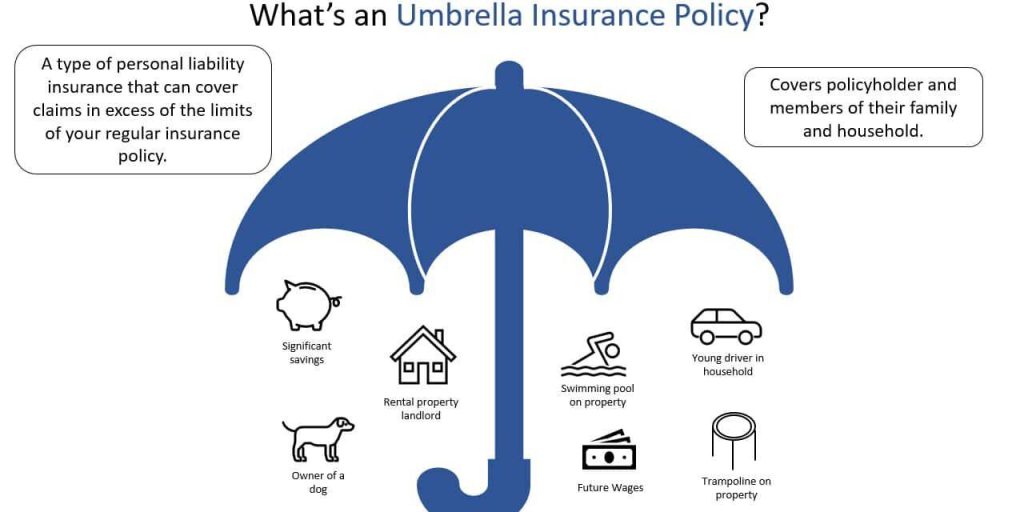

When it comes to safeguarding your assets, basic policies like auto, home, and renters insurance offer essential protection, but they often have coverage limits that might not be enough in a high-stakes situation. This is where umbrella insurance shines—it acts as an additional layer of security that kicks in once those primary policy limits are exceeded. Beyond the typical scenarios, umbrella insurance can cover risks that are generally excluded from basic policies, such as libel, slander, or false arrest. This means if you find yourself facing legal action due to personal injury claims or defamation, your umbrella policy can provide critical financial support.

Another big advantage is the breadth of coverage. Some of the key benefits many people don’t realize include:

- Worldwide protection—even incidents that happen abroad can be included.

- Coverage for rental properties if you own them, supplementing your landlord insurance.

- Protection for your personal assets in cases like dog bites or accidents on your property.

Unlike traditional policies, umbrella insurance fills in the gaps, providing peace of mind that you’re covered in unexpected situations that could otherwise drain your savings.

How Umbrella Insurance Can Save You from Costly Lawsuits

When a lawsuit arises, the financial consequences can quickly spiral out of control, even if you have standard insurance policies in place. This is where umbrella insurance steps in to provide an extra layer of protection, covering costs that exceed your primary policy limits. Imagine a scenario where a major car accident or a property damage claim results in legal fees and payouts that surpass your auto or homeowners insurance coverage. Without umbrella insurance, you’d be responsible for paying the difference out of pocket, which can lead to significant financial strain or even bankruptcy.

Umbrella coverage not only helps protect your assets but also offers peace of mind by covering a wide range of risks that might be excluded from other policies. This includes:

- Libel, slander, or defamation claims

- Rental property liability

- Legal defense fees and settlements

- Bodily injury or property damage liability exceeding your limits

By bridging the gap between your existing policies and excessive liability claims, umbrella insurance ensures you stay financially secure when unexpected lawsuits hit.

Who Should Consider Umbrella Insurance and When to Get It

Individuals who own significant assets or have a higher likelihood of being targeted in a lawsuit often find umbrella insurance to be an invaluable safety net. This includes homeowners with expensive property, entrepreneurs, and professionals who might face liability claims beyond what their primary insurance covers. Parents with teenage drivers or those who frequently host social gatherings at home may also benefit from this extra layer of protection, shielding them from unexpected legal expenses that can quickly escalate.

Timing is key when securing this coverage. It’s wise to consider umbrella insurance when your existing policies, such as auto or homeowners insurance, have liability limits that may not fully protect your net worth. If you experience a life event that increases your risk—like buying a new home, starting a business, or adding valuable assets—it’s a good signal to act. By getting umbrella insurance early, you ensure peace of mind knowing you’re covered before incidents happen, rather than scrambling afterward.

- Homeowners and landlords with high-value properties

- Business owners exposed to liability claims

- Parents with young drivers in the household

- Anyone experiencing life changes that boost asset value or risk exposure

Tips for Choosing the Right Umbrella Insurance Policy for Your Needs

When seeking extra protection beyond your standard insurance policies, it’s crucial to evaluate your personal risks and the coverage limits you currently have. Start by assessing your assets, including savings, property, and future earnings, to determine the coverage amount that truly safeguards your financial well-being. Remember, umbrella insurance typically kicks in after your primary coverage limits are exhausted, so having a clear understanding of your existing policies helps prevent costly gaps. Additionally, consider your lifestyle—if you frequently host large gatherings or own valuable assets, leaning toward a higher coverage limit can provide peace of mind against unforeseen liabilities.

Another wise step is to explore the policy’s inclusions and exclusions thoroughly. Not all umbrella policies cover every risk in the same way, so scrutinize details like lawsuits related to defamation, rental properties, or incidents involving uninsured motorists. Don’t hesitate to ask your insurer about any specifics that might apply to your unique situation. Also, shopping around and comparing quotes from multiple providers can save money and ensure you find a policy tailored to your needs. Remember, the right umbrella insurance policy is one that balances comprehensive coverage with affordable premiums—offering robust protection without stretching your budget.

To Conclude

At the end of the day, umbrella insurance might just be the safety net you didn’t know you needed—but won’t want to be without. Life can throw unexpected curveballs, and having that extra layer of protection can bring real peace of mind. Whether you’re a homeowner, a renter, or someone with assets to protect, it’s worth exploring how an umbrella policy can shield you from those “what if” moments. So, why not take a closer look? It could be the smartest, most affordable way to protect your future—and that’s something we can all appreciate. Stay safe out there!