When it comes to navigating health insurance, one term you’ve probably heard a lot is “pre-existing conditions.” But what does it really mean, and how does it affect your coverage? Whether you’re shopping for a new plan or just trying to understand your benefits better, knowing the ins and outs of pre-existing conditions can make a big difference. In this post, we’ll break down what pre-existing conditions are, how health insurance companies treat them, and what you need to keep in mind to make sure you’re covered when it matters most. Let’s dive in!

Table of Contents

- What Exactly Are Pre-Existing Conditions and Why Do They Matter

- How Health Insurance Companies Evaluate Pre-Existing Conditions

- Tips for Choosing the Right Insurance Plan if You Have a Pre-Existing Condition

- Steps to Take When Your Pre-Existing Condition Affects Your Coverage Options

- Future Outlook

What Exactly Are Pre-Existing Conditions and Why Do They Matter

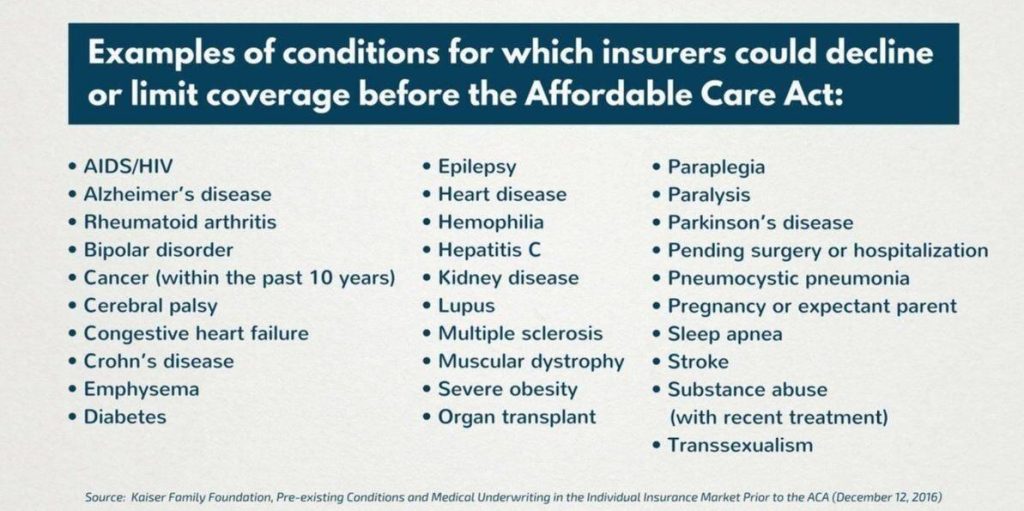

Pre-existing conditions refer to any health issues or medical diagnoses that a person has before applying for new health insurance coverage. These can range from chronic diseases like diabetes and asthma to past surgeries or injuries. Insurers often scrutinize these conditions because they can impact the level of care you need and, consequently, your insurance costs. Understanding what qualifies as a pre-existing condition helps you prepare for conversations with insurance providers and plan your healthcare expenses more effectively.

Why do these conditions matter so much? For starters, they can influence your coverage options and premium rates. Though many modern policies and regulations protect consumers from discrimination based on pre-existing conditions, some insurers may impose waiting periods or limit coverage on certain treatments. Here are a few key points to keep in mind:

- Disclosure is crucial: Failing to report known conditions can lead to denied claims or cancellations.

- Coverage varies: Not all plans treat pre-existing conditions equally, so comparing policies is essential.

- Legal protections exist: Laws like the Affordable Care Act help ensure fair treatment, but it’s vital to understand your plan details.

Navigating pre-existing conditions might seem complex, but with the right information, you can find insurance that truly supports your health journey.

How Health Insurance Companies Evaluate Pre-Existing Conditions

When health insurance companies assess risks related to pre-existing conditions, they dig deep into your medical history to understand the potential costs they may incur. This evaluation includes reviewing past diagnoses, ongoing treatments, and medication usage. Insurance underwriters use this information to predict how likely it is that you’ll need significant medical care in the near future. Factors such as the severity of the condition, how well it’s managed, and any recent hospitalizations can impact their decision-making process. The goal isn’t to disqualify applicants arbitrarily but to balance coverage options with sustainable premium rates.

It’s also important to note that policies from different companies vary widely in how they handle pre-existing conditions. Some may implement waiting periods before coverage kicks in for related treatments, while others could offer riders or exclusions specific to certain illnesses. Here are a few common ways companies handle these situations:

- Waiting Periods – A set timeframe during which claims for the condition are not covered.

- Exclusions – Specific services or treatments for the condition may be excluded from coverage.

- Premium Loading – Higher premiums to offset the expected treatment costs.

- Coverage Denial – In rare cases, refusal to cover the condition entirely.

Understanding these nuances can empower you to choose a policy that aligns with your unique health needs and financial comfort.

Tips for Choosing the Right Insurance Plan if You Have a Pre-Existing Condition

When you have a pre-existing condition, selecting the right health insurance plan can feel overwhelming. Focus on plans that explicitly cover your condition without imposing long waiting periods or exclusion clauses. Look for policies that offer comprehensive coverage for specialist visits, ongoing treatments, and prescription medications, ensuring you won’t face unexpected out-of-pocket expenses. It’s also wise to review the insurer’s network of doctors and hospitals to confirm your preferred healthcare providers are included.

Before making a decision, consider these key factors:

- Pre-existing condition clauses: Understand what conditions are covered and any waiting periods.

- Affordability: Balance premium costs with coverage benefits to avoid financial strain.

- Customer support: Choose insurers with responsive support to assist when you need it most.

- Renewability: Ensure the policy offers lifelong renewability so your coverage won’t be canceled due to your condition.

Steps to Take When Your Pre-Existing Condition Affects Your Coverage Options

When managing a pre-existing condition, proactive communication with your insurance provider is key. Begin by gathering all relevant medical documentation and treatment histories to clearly demonstrate your health status. This not only helps in obtaining accurate quotes but also ensures that you are transparent about your needs. Additionally, explore plans that include special accommodations or waivers specifically designed for individuals with chronic conditions. Many insurers offer tailored programs that might provide better coverage and lowered out-of-pocket costs.

It’s also important to compare multiple coverage options and ask about the details surrounding waiting periods, premium rates, and caps on certain treatments. Don’t hesitate to inquire about riders or add-ons that could enhance your protection without significantly increasing your premium. Sometimes, consulting with a licensed insurance broker who specializes in health plans for chronic conditions can uncover opportunities and discounts you might not find on your own. Remember, being informed and asking the right questions can empower you to secure a plan that truly supports your well-being.

Future Outlook

Navigating the world of pre-existing conditions and health insurance can feel overwhelming, but understanding the basics empowers you to make smarter choices for your health and wallet. Remember, being informed about how your insurance works with pre-existing conditions means fewer surprises and more confidence when you need care the most. Stay proactive, ask questions, and know that your health comes first—because at the end of the day, having the right coverage is all about peace of mind. Thanks for reading, and here’s to taking control of your health journey!