Thinking about life insurance beyond just a safety net? If you’ve heard about the “cash value” in some life insurance policies but aren’t quite sure what it means—or how to tap into it—you’re in the right place. Unlocking the cash value within your life insurance can open up surprising financial possibilities, from borrowing for emergencies to supplementing retirement income. In this post, we’ll break down what life insurance cash value really is, how it grows, and the smart ways you can use it to your advantage. Let’s dive in and demystify this powerful but often misunderstood feature!

Table of Contents

- Understanding Cash Value in Life Insurance and Why It Matters

- How Your Cash Value Grows Over Time Explained Simply

- Practical Ways to Access and Use Your Life Insurance Cash Value

- Tips for Maximizing the Benefits Without Jeopardizing Your Coverage

- Future Outlook

Understanding Cash Value in Life Insurance and Why It Matters

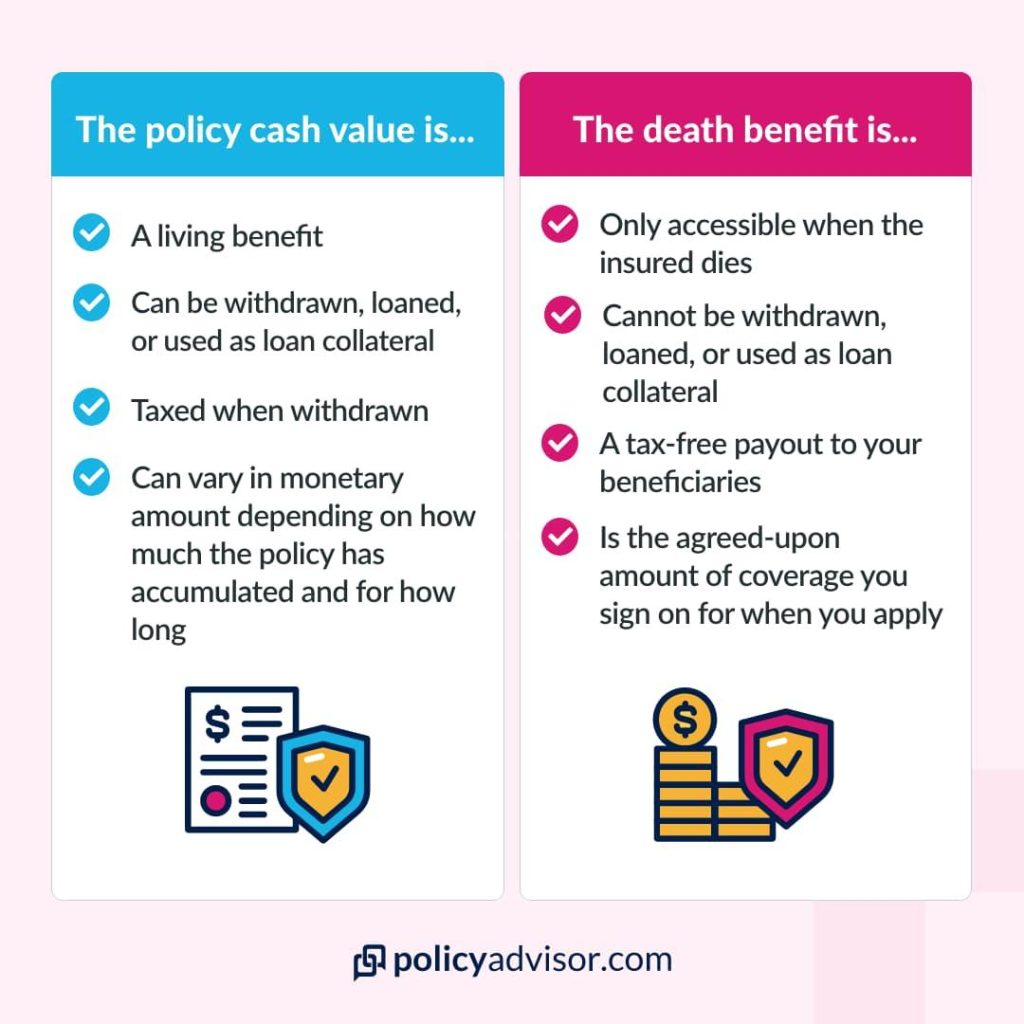

When you first think about life insurance, the focus often falls on the death benefit—the amount paid out to your beneficiaries after you pass away. However, many life insurance policies also build what’s known as cash value, a living benefit that accumulates over time. This portion acts like a savings component inside your policy, growing tax-deferred and accessible during your lifetime. Unlike term insurance, which expires without value if you outlive the term, permanent life insurance policies such as whole or universal insurance give you this financial flexibility. The cash value grows based on the premiums you pay and, depending on the policy, may increase with interest or investment gains.

Why does cash value matter? Beyond providing a death benefit, it offers a unique form of financial security and freedom. You can often borrow against it for emergencies, supplement retirement income, or even cover unexpected expenses without the hassle of a traditional loan. Here are some key points to keep in mind:

- Tax Advantages: Growth inside the policy is generally tax-deferred, meaning you won’t owe taxes as it accumulates.

- Loan Flexibility: Policy loans against the cash value usually have competitive interest rates and no set repayment schedule.

- Policy Surrender: You can choose to surrender the policy and receive the accumulated cash value, minus any fees or loans.

How Your Cash Value Grows Over Time Explained Simply

Think of your cash value like a little financial nest egg that steadily fattens over time. When you make your life insurance payments, a portion of those premiums is set aside—not just to cover your policy’s cost but to build this cash value. Unlike a regular savings account, this money grows tax-deferred, meaning you won’t pay taxes on the earnings until you access them. Plus, the growth rate often benefits from the insurance company’s investment strategies and can sometimes include guaranteed minimum interest, giving you a reliable way to watch your cash value climb year after year.

Here’s how the magic unfolds annually:

- Premium payments: Your incoming cash that feeds the policy.

- Cost of insurance and fees: Deducted amount ensuring your coverage stays active.

- Interest or dividends credited: Earnings that boost your cash value.

- Reinvested growth: Earnings that compound, building even more cash over time.

By understanding these moving parts, you can see that your cash value isn’t static—it’s an evolving asset that grows silently, offering a unique financial resource beyond just providing protection.

Practical Ways to Access and Use Your Life Insurance Cash Value

When it comes to tapping into your policy’s cash value, you have several smart options that can provide financial flexibility without jeopardizing your coverage. One popular method is taking out a policy loan. This doesn’t require credit checks or repayment schedules, and the interest rates are usually lower compared to conventional loans. Just remember, any unpaid loan balance reduces your death benefit. Another choice is to withdraw funds from the cash value directly, which can be especially handy for emergencies or major expenses. Unlike loans, withdrawals may reduce the policy’s value, so be strategic about the timing and amount.

Some policies also allow you to surrender dividends or cash value, turning them into a lump sum payment or applying them toward future premium payments. This can help ease your cash flow without dipping into other resources. Additionally, you might consider leveraging the cash value as collateral for personal loans or even to supplement retirement income through structured withdrawals or annuities. With these options in your toolkit, using your life insurance’s cash value becomes a viable, tailored solution for your financial needs.

- Policy Loans: Borrow against your cash value with low interest.

- Withdrawals: Access cash directly but be mindful of policy impact.

- Dividends: Apply dividends to premiums or receive as cash.

- Collateral Loans: Use your policy’s cash value to secure personal loans.

- Retirement Income: Convert cash value into steady income streams.

Tips for Maximizing the Benefits Without Jeopardizing Your Coverage

When tapping into the cash value of your life insurance policy, it’s crucial to strike a balance between enjoying the benefits and maintaining your protection. One of the best approaches is to regularly review your policy with a trusted advisor to understand the impact of withdrawals or loans on your death benefit. Keep in mind that while borrowing against the cash value can be a smart way to access funds without taxes, unpaid loans may reduce your coverage or even cause your policy to lapse. To stay on the safe side, always track outstanding loan amounts and consider making repayments when possible.

Another key strategy is to plan your withdrawals thoughtfully. Avoid dipping into your cash value during market downturns or early in the policy term, as this could limit growth or benefits down the road. Utilize your policy’s built-in flexibility by exploring options like partial surrenders or policy riders tailored to your needs. Some helpful reminders include:

- Consult a financial planner experienced in life insurance nuances.

- Maintain clear communication with your insurer about any changes.

- Prioritize keeping your premiums current to safeguard your coverage.

- Use cash value benefits as a supplement—not a replacement—to your overall financial plan.

Future Outlook

Unlocking the cash value in your life insurance policy doesn’t have to feel like decoding a secret treasure map. With a clear understanding of how it works, you can confidently use this feature to support your financial goals—whether it’s covering unexpected expenses, supplementing retirement income, or simply having a safety net. Remember, it’s all about knowing your policy inside out and working with your insurance provider to make the most of this valuable asset. So go ahead, take control, and let your life insurance do a little extra heavy lifting for your financial future!