When it comes to managing your health, having the right medical equipment and supplies can make all the difference. But navigating insurance coverage for these essential items can sometimes feel like a maze. Whether you’re looking into a wheelchair, oxygen tanks, or everyday supplies like bandages and diabetic testing kits, understanding what your plan covers—and how to get it—can save you both stress and money. In this article, we’ll break down the basics of medical equipment and supply coverage in a straightforward, friendly way so you can feel confident and informed every step of the way. Let’s dive in!

Table of Contents

- Understanding Different Types of Medical Equipment Coverage

- How Insurance Policies Determine What’s Included and What’s Not

- Tips for Navigating Claims and Avoiding Common Coverage Pitfalls

- Smart Ways to Maximize Your Benefits for Medical Supplies and Equipment

- Insights and Conclusions

Understanding Different Types of Medical Equipment Coverage

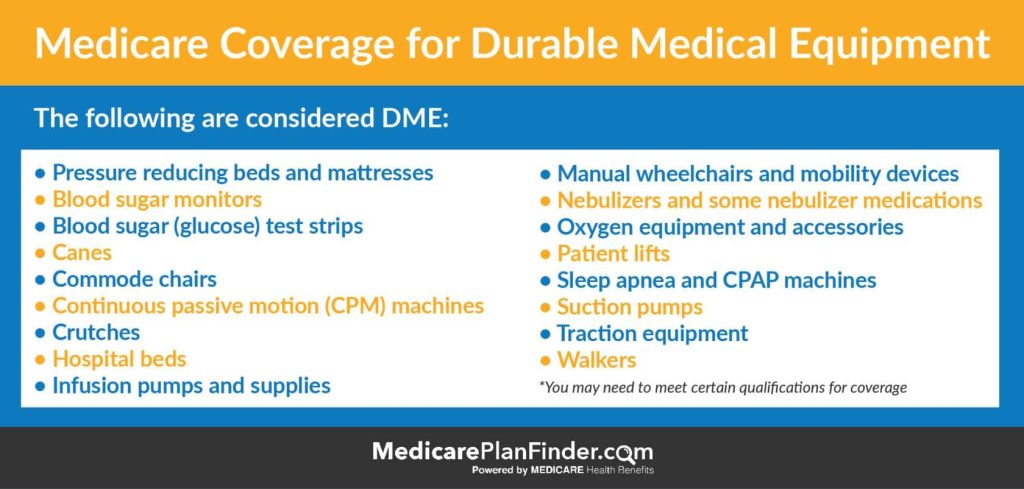

When it comes to medical equipment, insurance coverage isn’t one-size-fits-all. Different types of equipment are categorized and covered in various ways depending on their intended use, durability, and necessity. For example, durable medical equipment (DME) such as wheelchairs, hospital beds, and oxygen tanks often have specific coverage guidelines. These items are designed for long-term use and are usually prescribed by a healthcare provider, making them more likely to be fully or partially covered under many insurance plans.

On the other hand, disposable or short-term supplies like bandages, syringes, and some wound care products have different coverage rules. Some plans bundle these under general medical supplies, while others might require getting them through certain vendors to qualify for reimbursement. Key factors influencing coverage include:

- Medical necessity as documented by your doctor

- Durability and lifespan of the equipment

- Whether the equipment is reusable or disposable

- Insurance plan specifics and vendor agreements

How Insurance Policies Determine What’s Included and What’s Not

When it comes to insurance coverage, understanding the fine print is key to knowing which medical equipment and supplies are covered. Insurers often classify items based on their necessity and frequency of use, with coverage typically extending to durable medical equipment (DME) that supports a diagnosed medical condition. However, each policy has its own criteria, and what counts as “medically necessary” can vary widely. For example, a policy might cover a wheelchair or oxygen tank but exclude items like bathroom safety rugs or non-prescription mobility aids. This distinction is crucial because insurers aim to balance providing essential support while avoiding coverage of convenience items.

To help navigate this complexity, here are some common factors insurance companies look at when deciding coverage eligibility:

- Provider Authorization: Many policies require prior approval before purchasing equipment, ensuring it meets medical necessity standards.

- Type of Equipment: Coverage often favors durable items that are reusable and essential, such as hospital beds or CPAP machines.

- Prescription Requirements: A valid prescription from a healthcare provider is usually mandatory to confirm the need.

- Coverage Limits: Policies may cap the amount they’ll spend or limit how often equipment can be replaced.

By understanding these guidelines, patients can better prepare their claims and avoid surprises when selecting medical equipment essential to their care.

Tips for Navigating Claims and Avoiding Common Coverage Pitfalls

Smart Ways to Maximize Your Benefits for Medical Supplies and Equipment

When it comes to medical supplies and equipment, knowing how to navigate your benefits can save you both time and money. Start by thoroughly reviewing your health insurance policy to understand what is covered and the extent of that coverage. Many plans include essential durable medical equipment (DME) like wheelchairs, oxygen tanks, and walkers, but each comes with its own set of guidelines. Additionally, don’t overlook supplemental programs that might cover items your primary insurance doesn’t, such as diabetic supplies or home health aids.

To make the most of your benefits, consider these practical tips:

- Get pre-approval: Always check if prior authorization is required before you purchase or rent equipment to avoid unexpected out-of-pocket costs.

- Keep receipts and documentation: Proper records can streamline future claims and support reimbursement requests.

- Explore rental vs. purchase options: In some cases, renting might be more cost-effective, especially for short-term needs.

- Work with in-network providers: Choosing suppliers that accept your insurance can maximize coverage and reduce expenses.

- Ask about maintenance services: Some insurers cover repairs or servicing, which extends the life of your equipment.

Insights and Conclusions

Thanks for sticking with me through this deep dive into coverage for medical equipment and supplies! Navigating insurance can feel tricky, but understanding the basics helps you get the support you need without the extra stress. Remember, being informed is the first step to making confident decisions about your care. If you have questions, don’t hesitate to reach out to your provider or insurance company—they’re there to help. Here’s to staying healthy and empowered every step of the way!