When it comes to the trucking industry, safety isn’t just a priority — it’s a critical factor that can significantly impact operating costs. One area where this connection is especially clear is in insurance premiums. Truck driver safety records play a pivotal role in determining how much an insurer will charge for coverage. In this article, we’ll explore the direct link between a driver’s safety history and the cost of insurance, shedding light on why maintaining a clean record is essential not only for the safety of those on the road but also for the financial health of trucking businesses. Whether you’re a fleet manager, owner-operator, or simply curious about the mechanics behind insurance pricing, understanding this relationship can help you make smarter decisions moving forward.

Table of Contents

- Impact of Safety Records on Insurance Premium Calculations

- Analyzing Common Risk Factors Influencing Driver Safety Evaluations

- Strategies for Maintaining Strong Safety Records to Lower Insurance Costs

- Best Practices for Documenting and Reporting Safety Compliance

- To Wrap It Up

Impact of Safety Records on Insurance Premium Calculations

Insurance companies meticulously analyze a truck driver’s safety history when determining premium rates. A spotless record, free from accidents, violations, and claims, often results in lower premiums because it signals a reduced risk to the insurer. Conversely, repeated infractions or recent crashes can trigger the perception of higher risk, prompting insurers to increase premiums to offset potential future losses. This dynamic emphasizes the direct financial consequences tied to maintaining a clean driving history.

Several factors from safety records specifically influence cost calculations, including:

- Frequency and severity of past claims: More accidents or expensive claims usually lead to higher costs.

- Type of violations recorded: Serious violations (e.g., DUI, reckless driving) drastically raise premiums.

- Time elapsed since last incident: Long durations without incidents can gradually reduce premium rates.

- Consistency of compliance with regulations: Perfect adherence to safety rules often offers discounts or preferred rates.

Recognizing how these elements impact pricing encourages drivers to prioritize safety, not only to protect themselves and others but also to avoid costly insurance burdens.

Analyzing Common Risk Factors Influencing Driver Safety Evaluations

Insurance providers rely heavily on a variety of risk factors when assessing a truck driver’s safety profile. Among these, driving history stands out as a critical predictor. Frequent traffic violations, accident reports, and citations for moving infractions significantly elevate perceived risk. Additionally, factors such as hours spent driving without adequate rest and evidence of distracted driving further compound the likelihood of incidents. It’s not just the sheer number of miles logged but how safely those miles are driven that influences insurance costs. Furthermore, a history of compliance with safety regulations reflects a driver’s commitment to minimizing hazards, offering insurers greater confidence in lower claim probabilities.

Beyond individual driving behavior, external influences also shape safety evaluations. Environmental conditions—like weather, road quality, and urban versus rural routes—play a subtle yet important role. Insurance evaluators often consider the frequency and context of driving assignments to gauge risk comprehensively. Moreover, advanced telematics devices and in-cab monitoring systems provide real-time data on driver habits, allowing insurers to pinpoint risky patterns such as harsh braking, rapid acceleration, or erratic lane changes. This granular insight leads to more personalized risk assessments and potentially rewards those maintaining exemplary driving standards.

- Traffic violation history

- Compliance with safety regulations

- Driving shift patterns and rest adherence

- Environmental and route factors

- Telematics and behavioral monitoring data

Strategies for Maintaining Strong Safety Records to Lower Insurance Costs

Maintaining an impeccable safety record is not just about adhering to regulations; it’s a strategic investment that directly impacts your insurance premiums. One of the most effective approaches is implementing a robust safety training program tailored specifically for your drivers. Regular workshops, practical simulations, and consistent reinforcement of safe driving habits cultivate a culture of responsibility and vigilance. Additionally, leveraging telematics and GPS tracking technologies can provide real-time feedback and detailed reports on driving behavior, enabling fleet managers to address risky conduct before it escalates into incidents. Such proactive measures not only reduce accident rates but also demonstrate to insurers that risk is being actively managed.

Additional strategies include:

- Conducting comprehensive pre-employment background checks to ensure drivers have a clean record.

- Promoting wellness programs to mitigate fatigue and improve driver alertness.

- Establishing clear disciplinary policies for safety violations to maintain accountability.

- Encouraging open communication channels where drivers can report hazards or near-misses without fear of retribution.

Incorporating these elements into your operational framework signals to insurers that your fleet prioritizes safety above all else. Over time, this approach solidifies your reputation as a low-risk client, paving the way for more favorable insurance rates and potentially significant cost savings.

Best Practices for Documenting and Reporting Safety Compliance

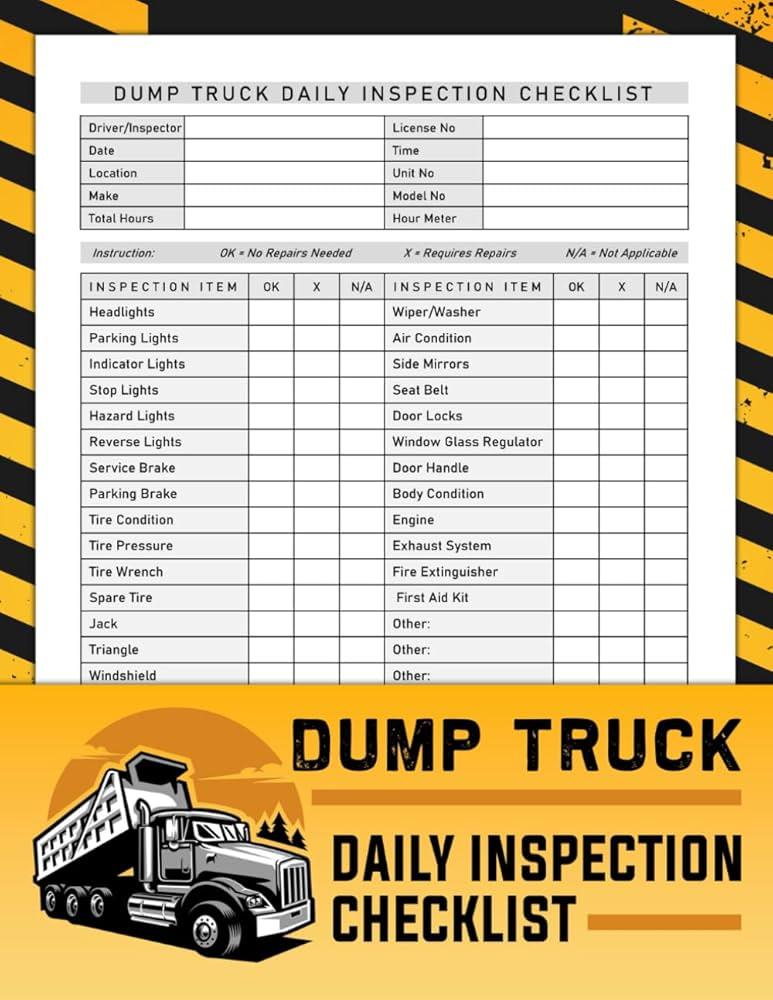

Maintaining precise and thorough records is fundamental to demonstrating a company’s dedication to safety, which insurance providers heavily weigh when calculating premiums. Ensuring that all safety compliance activities are meticulously logged—ranging from routine vehicle inspections to driver training sessions—can directly reflect a lower risk profile. Accurate documentation should include timestamps, signatures, and specific details about any issues encountered and corrective actions taken. Such rigor not only fosters transparency but also expedites claims processing and reduces disputes, proving invaluable in negotiations with insurers.

To streamline the process, companies should implement standardized reporting protocols, leveraging digital tools that automatically track compliance metrics and generate comprehensive reports. Key steps include:

- Consistent use of electronic logging devices (ELDs): Captures real-time operational data to support compliance verification.

- Regular audits and internal reviews: Identify gaps early and reinforce accountability.

- Clear communication channels: Encourage drivers and safety managers to promptly report incidents or near-misses.

By actively embedding these practices into daily operations, fleets build a robust safety culture that insurers recognize as a sign of lowered risk, ultimately translating into more favorable insurance rates and better coverage options.

To Wrap It Up

In the complex world of commercial trucking, safety records are far more than just numbers—they directly influence insurance costs, operational budgets, and ultimately, the bottom line. Understanding how these records impact premiums can empower drivers and companies to prioritize safe practices, reduce risks, and negotiate better rates. By investing time and effort into maintaining stellar safety performance, truck drivers don’t just protect themselves on the road—they also pave the way for more affordable insurance and stronger business prospects. Staying informed and proactive is key to turning safety into a strategic advantage in the trucking industry.